LJT-MTD

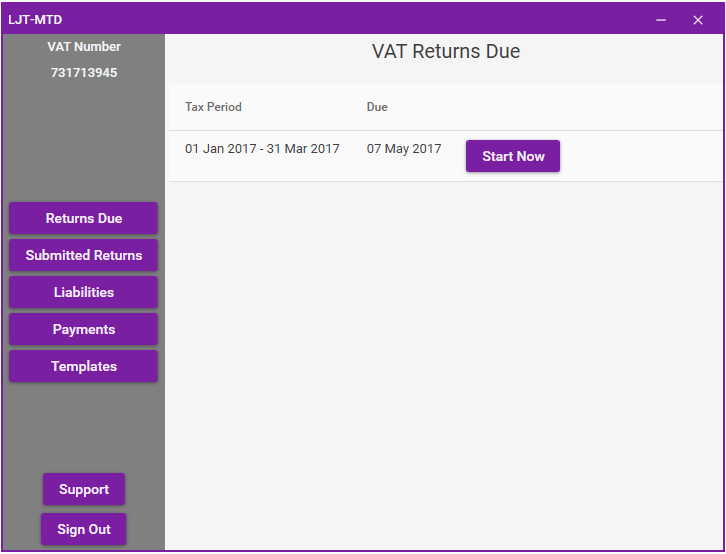

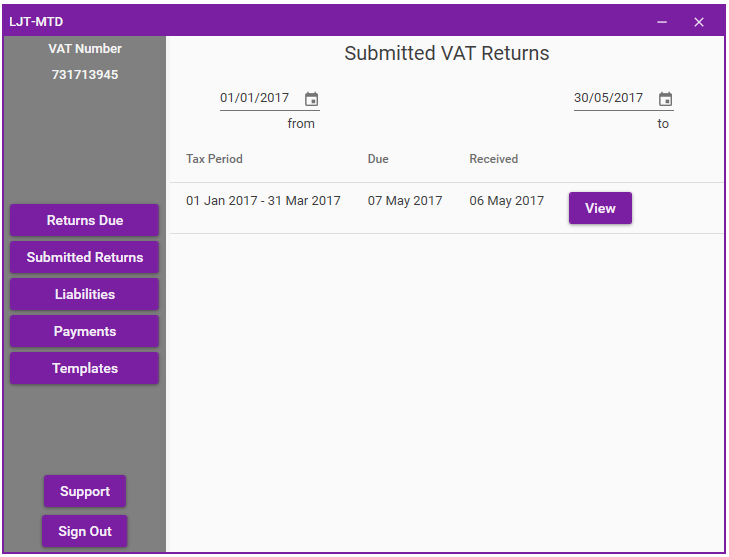

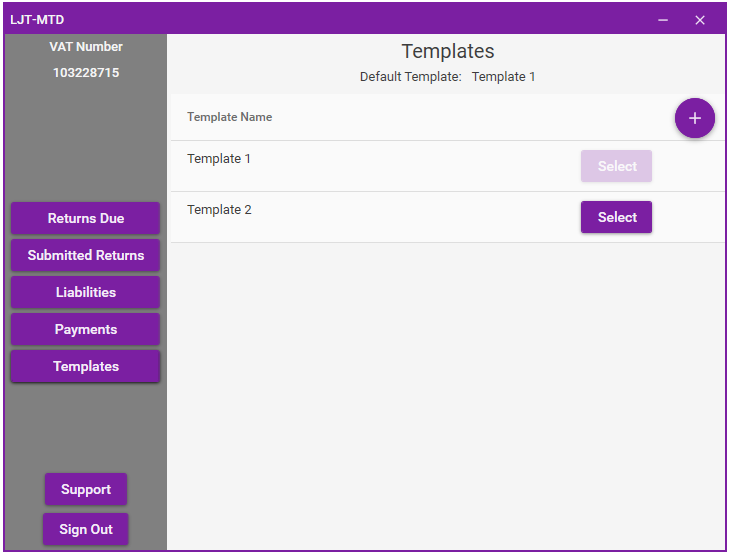

VAT Bridging Software recognised by HMRC

What is Making Tax Digital (MTD)

Making Tax Digital (MTD) is part of HMRC’s vision to digitalize the UK’s tax system and make it easier for businesses and individuals to keep on top of their taxes.

All businesses with a taxable turnover above the VAT registration threshold are required to submit their VAT Returns electronically, via MTD compliant software.

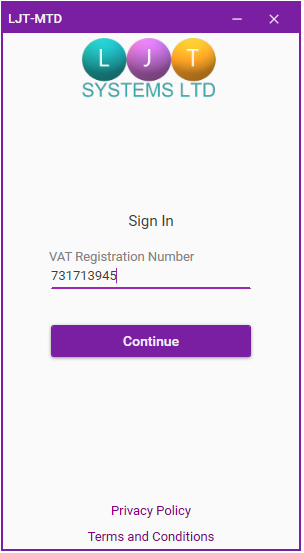

To purchase your 12-month subscription for LJT-MTD, please click here.

*You must make sure you provide your VAT registration number in order to use this product.

VAT Return Changes (08/04/2021)

VAT Return Before Brexit

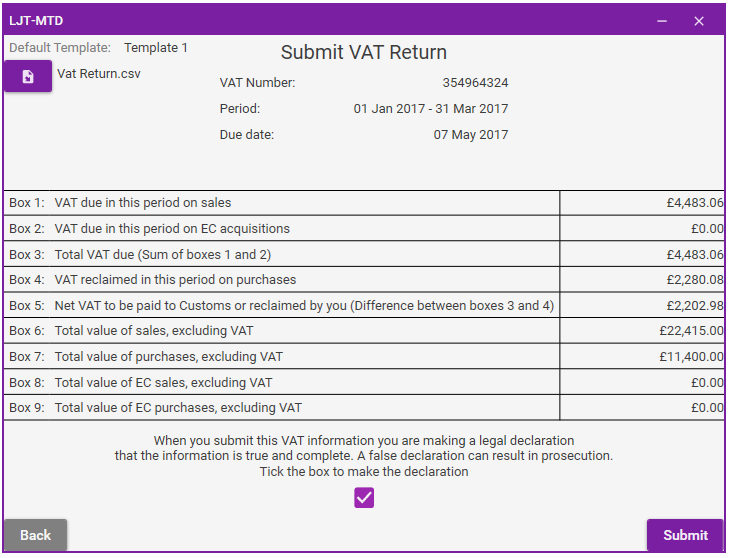

Box 2: VAT due in this period on acquisitions from other EC Member States.

Box 4: VAT reclaimed in the period on purchases and other inputs (including acquisitions from the EU).

Box 8: Total value of all supplies of goods and related costs, excluding any VAT, to other EC Member States.

Box 9: Total value of all acquisitions of goods and related costs, excluding any VAT, from other EC Member States.

VAT Return After Brexit

Box 2: VAT due in the period on acquisitions of goods made in Northern Ireland from EU Member States.

Box 4: VAT reclaimed in the period on purchases and other inputs (including acquisitions in Northern Ireland from EU member states).

Box 8: Total value of dispatches of goods and related costs (excluding VAT) from Northern Ireland to EU Member States.

Box 9: Total value of acquisitions of goods and related costs (excluding VAT) made in Northern Ireland from EU Member States.

There are no changes to boxes 1, 3, 5, 6, and 7

VAT Return Notes After Brexit

Box 1

Include the VAT due on all goods and services you supplied in the period covered by the return. This does not include exports or dispatches as these are zero rated. Include the VAT due in this period on imports accounted for through postponed VAT accounting.

Box 2

For goods moved under the Northern Ireland protocol only. Show the VAT due (but not paid) on all goods and related services you acquired in this period from EU Member States.

Box 3

Show the total amount of the VAT due i.e. the sum of boxes 1 and 2. This is your total Output tax.

Box 4

Show the total amount of deductible VAT charged on your business purchases. This is referred to as your ‘input VAT’ for the period. Include the VAT reclaimed in this period on imports accounted for through postponed VAT accounting.

Box 5

Take the figures in boxes 3 and 4. Deduct the smaller from the larger and enter the difference in box 5. If this amount is under £1, you need not send any payment, nor will any repayment be made to you, but you must still fill in this form and send it to the address on page 1.

Boxes 6 and 7

In box 6, show the value excluding VAT of your total outputs (supplies of goods and services). Include zero rated, exempt outputs and EU supplies from box 8. In box 7, show the value excluding VAT of all your inputs (purchases of goods and services). Include zero rated, exempt inputs and EU acquisitions from box 9.

Boxes 8 and 9

In box 8, show the total value of all supplies of goods and related costs, excluding any VAT, to EU Member States from Northern Ireland. In box 9, show the total value of all acquisitions of goods and related costs, excluding any VAT, from EU Member States to Northern Ireland.

EU trade under the Northern Ireland protocol only

Only use boxes 8 & 9 if you have supplied goods to or acquired goods from a EU Member State under the Northern Ireland protocol. Include related costs such as freight and insurance where these form part of the invoice or contract price. The figures should exclude VAT. You can find details of EU Member States in Notice 60 and Notice 725 or at www.gov.uk/topic/business-tax/vat and at www.uktradeinfo.com under Intrastat.

To purchase your 12-month subscription for LJT-MTD, please click the link below which will take you to our ecommerce website.

LJT-MTD (Making Tax Digital) 12 Month Subscription